4 ways to prepare for next year’s audit

Every fall, CPAs are busy preparing for audit season, which generally runs from January to April each year. This includes meeting with clients, assigning staff >>

Every fall, CPAs are busy preparing for audit season, which generally runs from January to April each year. This includes meeting with clients, assigning staff >>

You’d be hard-pressed to find many employees these days who don’t use smartphones for some aspect of their jobs. Even someone who works behind a >>

Amid urgent concerns about scams, the IRS has immediately halted acceptance of new claims for the Employee Retention Credit (ERC), at least through year end. IRS >>

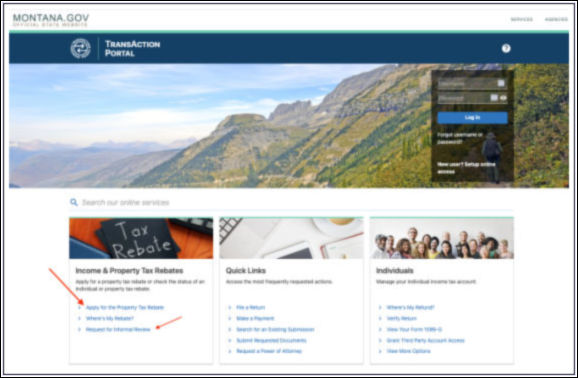

Deadline to apply is October 1. Here is a screenshot of where to locate the rebate application on the Montana TAP website (https://tap.dor.mt.gov/_/): It has been >>

What the lower threshold reporting requirement means, and how it will impact individuals and businesses. Attention personal and business tax filers! The IRS has implemented changes >>

As summer slips away and fall shuffles forth, business owners and their leadership teams might want to take a look at the overall marketing strategy >>

The day-to-day demands of running a business can make it difficult to think about the future. And by “future,” we’re not necessarily talking about how your >>

As the Fed continues to do battle with inflation, and with fears of a recession not quite going away, companies have been keeping a close >>

Attention all JCCS clients! The professionals at JCCS want to properly update and inform you on the Montana Property Tax Rebate items, including the rebate letter >>

We are excited to announce that JCCS is expanding its Montana service offerings into the Bozeman and Gallatin Valley markets. It has been a multiyear search >>